Excellent service… Very impressed with downside protection… A perfect foil to ‘buy and hold’ of the mainstream press.

On 12th March 2020, ‘Red Thursday’, when Bloomberg terminals around the world turned crimson, we at Saltydog didn’t have to panic. The Dow Jones Industrial Average suffered its worst one-day points loss ever and markets around the world were in freefall. The spread of the coronavirus and the collapse of the oil price had led to a massive sell-off, wiping trillions of dollars off the value of companies around the world.

In our demonstration portfolios we had already reduced our exposure to the equity markets to zero.

The following week the Dow Jones, which represents the largest economy in the world, had an even greater fall. It lost 12.9%, nearly 3,000 points, in one session.

Even after a buoyant 2019, and eleven consecutive years in a bull run, thing’s didn’t bode well as we moved into 2020. January got off to a bumpy start when, on day three, Iran’s top military commander, General Qasem Soleimani, was killed in a U.S. airstrike in Iraq. The Americans were responding to attacks by Iran-backed militias on their American Embassy in Baghdad. After the general’s death the Iranians retaliated by firing 16 short-range ballistic missiles at two Iraqi bases that host U.S. troops. Fortunately, the military action didn’t escalate any further.

Just when it looked like one catastrophe had been averted, another potential global crisis emerged. Health authorities in China reported the country’s first death from a new type of coronavirus. By the end of January, the World Health Organization had declared it an international public health emergency. All the unrest weighed heavily on global equity markets and most stock market indices went down in January.

During February they started to recover. The Dow Jones Industrial Average had a record closing high on the 12th February, at 29,551, and the S&P 500 and the Nasdaq followed a week later.

At the time the UK’s FTSE100 was showing a gain of over 2% since the beginning of the month and trading just above 7,450.

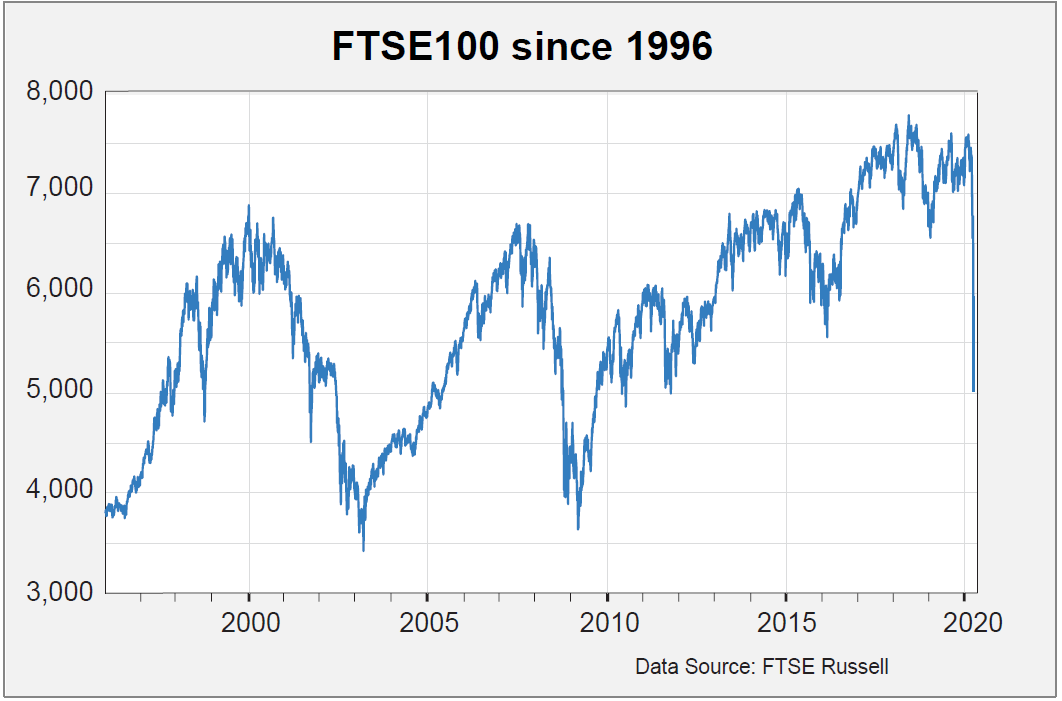

Less than a month later the Dow was down below 20,200 and the FTSE100 had lost a third of its value – dropping below 5,000 for the first time since 2011.

This latest variant of the virus, COVID-19, was initially discovered in Wuhan, the capital of Hubei province in China. The first case was identified in December 2019 and on the 11th January the first death from the virus was reported. Seven other people were in a critical condition and forty-one people had been diagnosed with the virus.

By the end of January, the total confirmed cases had risen to 9,800 and more than 200 people had died. The World Health Organisation (WHO) declared the outbreak a global health emergency.

The reason the markets got rattled in February was because investors suddenly realised that it could not be contained. Cases weren’t just limited to China and the Far East, but they were cropping up all over the world. By the end of February there were more than 85,000 cases and nearly 3,000 people had died. There were confirmed cases in 56 countries.

On the 11th March, the WHO declared COVID-19 a global pandemic. In three months, it had spread to more than 121,000 people from Asia to the Middle East, Europe and the United States.

The personal, social and economic effects will be felt for years to come.

For reasons which I don’t claim to understand, markets tend to move in cycles. They do not go up in a nice straight line, but have frequent corrections along the way. It’s not that unusual for prices to drop by around 10%, but they usually recover relatively quickly.

It’s also easy to forget that much larger market crashes also happen with alarming frequency.

There was the bursting of the dotcom bubble in 2000-03, and then in 2008/9 it was the financial crisis. Both times stock market investments could have been cut in half.

Now it’s the coronavirus outbreak. Is history repeating itself?

By mid-March 2020, the FTSE100 had lost a third of its value in just a few weeks and looked like it could head lower.

At times like this it is difficult for private investors to know what to do. On the whole, the financial industry promotes a buy and hold approach. They maintain that it’s too difficult to time the markets and so you shouldn’t try. It’s ‘time in the market, not timing the market’ that’s important.

At Saltydog Investor we disagree.

Instead of ignoring the ups and downs of the market, we encourage our members to respond to them. The principle is simple: any market trend – whether up or down – is likely to keep going in the same direction. Rising prices tend to keep rising, and falling prices tend to keep falling. This is known as the ‘momentum effect’ and is a well-researched phenomenon.

As trend investors we buy into uptrends and get out of downtrends. When there are small corrections it does mean that sometimes we sell things, only to buy them back a few weeks later when the price might be higher, but it does help avoid wealth-destroying crashes.

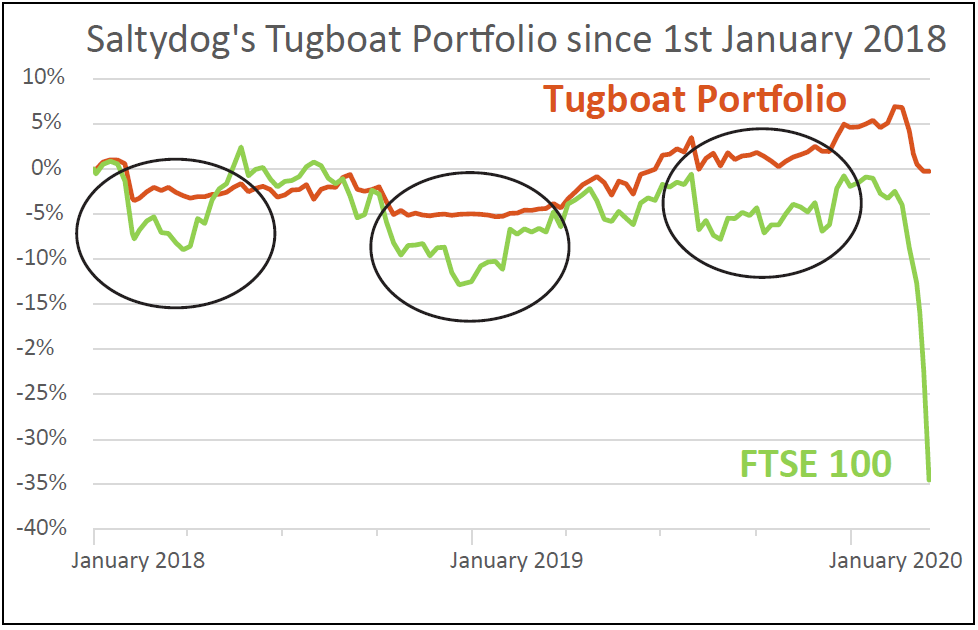

Between the beginning of 2018 and March 2020, there were four times when we saw markets starting to fall quite significantly. On each occasion the value of our portfolios has dropped and so we’ve headed for safety. The value of our portfolios then remained relatively steady as markets continued to fall.

The graph below shows the performance of one of our demonstration portfolios over this period.

In the first three cases the UK’s main index recovered fairly quickly and so we stepped back into the markets.

This latest downturn looks very different.

On the 12th February our portfolio was at an all-time high, having gone up over 12% in the previous twelve months. More than 90% of its total value was invested.

In the next two weeks it lost 2.5% and we started selling. By the 10th March we were 100% in cash.

The FTSE 100, and other global indices, were still in freefall and there was no way of telling how low they could go. It may be a slightly unfair comparison, because the FTSE100 doesn’t include any reinvested income, but even when that is accounted for it was still down over 28% since the beginning of 2018.

We are in the fortunate position of being able to wait until there are signs of a meaningful recovery before starting to invest again.

There’s no need for you to live with pitifully low returns. Nor do you need to resign yourself to a roller-coaster ride with your wealth – seeing your investments plummet just as often as they go up.

If you’re prepared to take a more active role in your investments, you too could make consistent, market-beating gains, without taking on crazy risks.

I’d like to show you how.

Let’s start with where a lot of investors go wrong.

The stock market is volatile.

It goes up, it goes down. Every now and then there are big booms, and also huge crashes.

As an investor you need a way of coping with all this movement in the markets. And for most people that means simply “buy and hold”.

This is the passive approach to investing, where you don’t try to respond to market movements at all. Instead you ignore them. In other words you buy stocks or funds and hold on to them for months or years, irrespective of what the market does – and trust that you’ll come out on top over the long term.

Why do most investors do this?

For one, it doesn’t take much work. (One good reason why financial advisors are also fond of this approach).

But more importantly, most people simply don’t believe it’s possible to get in and out of the market at the right time. That would be “timing the market”, and only super-sophisticated investors or whizz-kid traders are supposed to attempt that.

Here’s the thing: this is simply not true.

It is perfectly possible for an ordinary investor to take advantage of market uptrends and avoid downtrends. I know, because I’ve done it very successfully for years. And I’m going to show you how.

But for now let’s look at what most investors do. What happens if you simply buy and hold, sticking with your investments for the long term and not reacting to anything the market does?

The fact is, there are two big potential risks with the passive, buy-and-hold approach.

First, you’ve got a very good chance of experiencing enormous losses along the way.

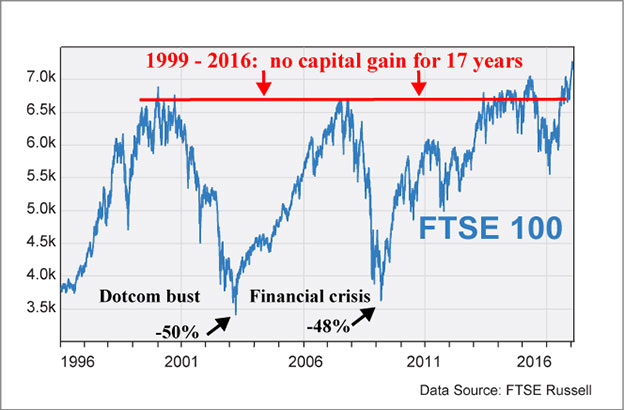

Huge market crashes happen pretty frequently. In only the last 15 years there have been two crashes of 50%. There was the dotcom bust of 2000-03. And then there was the financial crisis of 2007-09.

Both times your stock market investments would have been cut in half.

Not only that, but even if you’d patiently endured these two market crashes and stuck it out for nearly two decades, you could well have achieved capital growth of precisely... zero.

Just look at the chart below to see what happened.

After hitting a peak of nearly 7,000 in 1999, the FTSE 100 never went significantly higher for the next 17 years.

It’s only in 2017 that it started to really move above that level.

Is that what you want with your investments?

If you were hoping for capital gains, that’s seventeen years of going nowhere. Nearly two decades. How long are you prepared to be a ‘passive’ investor, hanging on in the market to see any positive return on your money? Thirty years? Forty?

This is one fatal flaw of ‘buy and hold’ investing.

Get in at the wrong time and you could buy and hold for decades, and see little or nothing for it.

You never know when the next big crash could wipe out years of hard-earned gains. That’s definitely not something you want to happen as you’re getting closer to retirement.

And the second problem with buy and hold?

You can miss out on some fantastic opportunities to make money.

The world doesn’t stand still, and neither do markets. New companies emerge and grow, whilst old ones fade away. New sectors and regions come into favour, whilst established ones stagnate.

If you - or your financial advisor working on your behalf - just invest in the market as a whole or in long-running ‘value’ investments and then stick with those for months or years, you could easily be missing out.

So how can you become an effective active investor instead?

How can you profit from upward trends, without having to lose it all when the market heads down again?

Here’s where we come to the secret that helped make Jesse Livermore so rich, and which is key to the success of my own system.

Everyone has heard the expression “Buy low, sell high”.

In other words you look for investments that seem cheap, undervalued, or heading down, hoping that they’ll go up again, like this:

Intuitively, it makes perfect sense. Buy something when it’s cheap, and then wait for the price to rise again.

But it’s not the only way of making money in the markets. And my experience tells me that it’s not the most effective way, either.

The basis of my system is known as momentum or trend investing. It starts from a different premise entirely.

Instead of looking for investments that have fallen in price, trend investors like me get excited about prices that are rising.

Why? Because, thanks to what’s known as the ‘momentum effect’, it’s likely that any market trend – whether up or down - will keep heading in the same direction.

Rising prices tend to keep rising, and falling prices tend to keep falling.

So a trend investor is on the lookout for investments like this:

For many people this is counter-intuitive. If a share has hit a new high, most people think it will go back down again – and they’re reluctant to invest at that point.

But a lot of times, they should. A new high is a very positive sign.

You buy into a rising trend, and hold on as long as the price keeps rising.

Why does this work? Essentially because of the herd behaviour of investors. In the words of wealth manager Ben Carlson:

“Fear, greed, overconfidence and confirmation bias can lead investors to pile into winning areas of the market after they’ve risen... or pile out after they’ve fallen.”

By using a trend investing strategy, you can take advantage of the market’s herd behaviour - and make more money.

There’s plenty of formal research that bears this out. One paper in the Journal of Portfolio Management states unequivocally:

“The existence of momentum is a well-established historical fact”.

In the words of the Boy Wonder, Jesse Livermore, himself:

“It takes continuous buying to make a stock keep going up. As long as it does so with only small and natural reactions from time to time, then it is a buy.”

Or as famous trader Richard Dennis said in the 1980s:

“Markets in motion tend to stay in motion”.

And here’s John Stepek, editor of MoneyWeek magazine, who’s evaluated innumerable investment methods over the years:

“Chasing momentum is such a successful investment strategy.”

On top of this, my direct experience (and profits) over the past seventeen years has confirmed to me - and to other investors who use our Saltydog system – the huge benefits of trend investing.

Of course the momentum effect doesn’t work on every single occasion, and it doesn’t continue indefinitely. At some point every upward trend will flatten off or start heading downwards.

But it certainly happens often enough to make trend investing a great method for catching upward movements, and also – just as important - for getting out when the market starts to turn down.

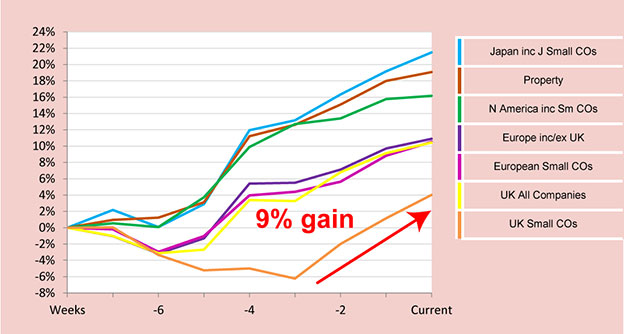

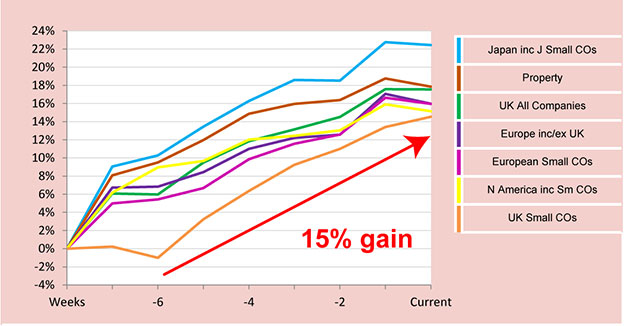

So let me show you how it works. As an example, here’s how we spotted a long uptrend in UK small companies, using our own easy-to-use charts and data.

In August 2016 we saw a new positive trend emerging. As you can see from the chart below (the orange line at the bottom), although the UK small companies sector had been falling, there was a sudden turnaround at the end of July 2016 with a 4-week gain of roughly 9%.

New strong trend emerges: 9% gain in 4 weeks

According to our rules, this 4-week positive uptrend was enough to get us interested and we made an initial investment.

This trend continued to move upwards over the following weeks, rising to a healthy 15% gain by the end of the month. So, with increasing confidence in this trend, we added to our investment.

Three weeks later: the trend is up 15% and rising

This process continued over the following months, with the UK small companies sector continuing to rise, and us adding more money to it.

The upshot was that over the space of ten months – from August 2016 to June 2017 – our demonstration portfolio showed a very nice 26.8% gain from this trend.

This illustrates two key points: how we can spot an uptrend as it starts to emerge, and how we gradually add more money as a trend becomes more established.

Thus we “ride our winners”, and can keep making more money on the way up.

As I’ve explained, our trend investing system is based on identifying movements in particular market sectors.

At any one time, some sectors are heading upwards, whilst others are flat or heading downwards.

For example, during 2015 property steadily moved up, whilst stocks headed down. In the latter part of 2016 small company shares zoomed ahead – as we’ve just seen - whilst large companies lagged behind.

Shares, bonds, property, emerging markets, technology, high-yielding companies and so on… the situation is always changing.

You might think it’s complicated to invest in particular sectors, but it’s not at all. It’s extremely easy, using the relevant funds. Whichever sector you’re interested in (and we want the ones heading up), there is a huge variety of possible funds to invest in – and our system picks out the very best performers.

You can think of trend investing like putting your money on a horse race, except with one enormous advantage - as the race progresses, you are always able to switch your money to the leading horse, so that you’re in the best possible position throughout.

In other words, your money is always making the best return that the current conditions allow – riding upward movements in the market, and avoiding the downturns.

Obviously enough, this is an active system of investing.

It means you need to be monitoring the market regularly – though no more than once a week – using the special data and charts that we provide. And you need to be moving your money in and out of different sectors, to take advantage of the uptrends and to avoid the downtrends.

In case you’re wondering, it’s not at all difficult if you follow our simple rules. I’ll explain more about how it works shortly.

Now, as you may be aware, what I’ve just described is not the mainstream view of how you should be investing.

Far from it.

In fact the Saltydog system goes completely against what most investment advisors, professionals, fund managers, gurus and journalists tell you to do.

These experts all say that private investors should not attempt to get in and out of the market. They think that anyone who tries to do so is mistaken and will lose money. They tell you to stick to ‘passive’ investing.

What our users have said about trend investing:

I have long given up trying to understand the stock markets from a fundamentals point of view. There’s no obvious correlation and I see it more of a herd mentality. So therefore I like the Saltydog system.

Value investing, which I had been trying to apply, is not for one in his late 70s. You have to stomach long periods when key holdings are deeply under water. Back the horse that IS running fast, not one that just might run fast… In 2015 [when the FTSE 100 went down 5%] I made 8.8%.

I like being able to quickly react to changes in the market. My other investments which are supposed to be actively managed by an IFA hardly seem to change from one year to the next and I keep being told “it’s for the long term”, which seems lazy to me.

So you’re probably wondering…

… if all these investment professionals say that “timing the market” is impossible for a private investor, then how can the Saltydog method work?

And how come there are so many satisfied Saltydog members, showing extremely positive results in their portfolios?

So let’s go through the main reasons the experts give for why you shouldn’t try to take advantage of market trends.

I’ll tell you what we think, you can hear from current Saltydog users, and then you can decide for yourself.

MAINSTREAM OBJECTION #1:

“Private investors can’t time the market”

The first objection to active investing is that private investors are demonstrably bad at it.

Most investors, left to their own devices, time the market completely wrong. They get frightened by market crashes and sell out on the way down. And then they wait until a bull market has really got going, and buy late on the way up. So they buy high and sell low – the exact opposite of how to make money.

In fact a study conducted in the US found that, over the last 30 years, the average investor in funds made an annual return of just under 4%. That’s while the US market (the S&P 500) made an annual return of 11%. In other words, private investors under-performed the market by 7% every year, for three decades!

This is a pretty shocking statistic, and would no doubt be replicated here in the UK. The primary emotions of fear and greed are true of investors anywhere, leading the vast majority of them to make extremely unprofitable decisions.

So one obvious moral to draw from this is: Don’t try to be clever about timing the market – you’re just not up to it. Don’t even bother.

And that’s exactly what most investment advisors say.

There’s even a saying that encapsulates this view: “It’s not about timing the market, it’s about time in the market”. In other words, you’re far better off buying and holding.

But here at Saltydog, we have an entirely different view.

Yes, most investors aren’t good at timing the market. We don’t disagree with that.

But most investors don’t have a clear method or strategy that they apply. They’re simply at the mercy of the latest market news – getting frightened when the market drops, and getting over-optimistic when it heads up. In other words, they’re making very important decisions based only on vague ideas, feelings or guesses – which can easily change from one day to the next.

The key point here is that the Saltydog system is not based upon a vague, subjective view of what the market, a fund or a stock might be about to do. It’s a system. It’s based on hard numbers. And there are clear rules to follow.

So with Saltydog you’re not acting on your own hopes, fears or hunches of where the market might be heading. On the contrary, you look at some very specific numbers and charts which we update for you every week – data that clearly shows you trends that are already happening in the market – and you make your decisions from that.

It’s not going by your own feelings. And it doesn’t rely on you making predictions or guessing where the market might be heading next. Instead it’s looking at the weekly Saltydog data and following a few simple rules.

As long as you’re capable of comparing a few numbers (“This is the highest… These are the most consistent”) and following some basic guidelines, it’s perfectly possible for you to take advantage of market trends using the Saltydog system.

Here’s what people using the Saltydog system – private investors just like you – have said. And please note, they were investing over a period when the FTSE’s annual performance was often flat or even negative:

It’s easy to understand and lets you know the sectors which are doing well at present. I’m up 25% in 18 months… It’s worth every penny.

It’s easy to follow and I’m gaining in confidence. My initial investment has grown 30% in under 3 years. Delighted.

33% in 3yrs since subscribing.

Since October 2010 I have made an annualised 9.69%… I base decisions on the data used in Saltydog, which is very good.

Passive investing:

the argument for it

Let me make it clear: there is a very solid case for long term passive investing – where you buy cheap index tracking funds, diversify, invest regular amounts month-by-month, and rebalance your portfolio every now and then. If you do this, then when the market falls, you benefit from buying shares at cheaper prices – helping your returns over the long term. This approach is also simple to operate, taking very little time.

Of course nothing comes without a price. And for all its simplicity, passive investing has two important requirements: emotional self-discipline, and a very long time-frame i.e. decades. It’s very uncomfortable holding on and continuing to invest when markets are plummeting and you’re watching your wealth dropping by thousands or tens of thousands of pounds. Plus, for many investors, retirement isn’t decades away – it may be only ten or so years ahead, or right now.

Also if you’ve finished accumulating your savings pot and aren’t contributing further regular amounts to your investments, a falling market is simply going to lose you money – rather than be an opportunity to buy cheaper shares.

Personally, I don’t like losing money, ever. And I’m not prepared to wait literally for decades to see if a passive investing strategy eventually produces the results I need. I want to actively manage my investments. And I know my Saltydog system works – which is why I use it.

I like the fact that the work is done for me re. trend analysis of performance. Returns in three full years: 16% (2013), 7.5% (2014) and 10.5% (2015).

About 25% in 3 years. It clearly beats other ‘systems’.

I like the concise structure of how funds performance is measured and displayed. Performance 2015: 16%.

I have averaged 12% using a blend of my own choices and Saltydog. I find it a thoughtful, professional and productive system that does ‘everything it says on the tin’.

You see why I’m so confident that the Saltydog system works for ordinary investors?

I strongly believe that any reasonably intelligent and motivated investor can achieve this kind of performance using Saltydog, and that includes you.

So now let’s hear the next objection from the mainstream experts.

MAINSTREAM OBJECTION #2:

“Active investing is costly and your gains will be eaten up by trading fees”

The next objection to active investing is that it’s extremely costly.

Well, the answer to this is simple: No, it isn’t.

OK, it’s a bit more expensive than doing little or nothing with your portfolio. But the charges probably aren’t what you imagine at all.

Let’s say you have a portfolio of £100,000. With the largest fund supermarket in the country it will cost you precisely £450 a year to buy and sell as many funds as you like, as often as you like.

You pay a 0.45% management charge per year (that’s your £450) and then there is no charge at all for buying and selling funds. You can buy and sell as often as you please, without incurring a single additional penny in costs.

Other brokers are even cheaper. With a £100,000 portfolio it's possible that it could cost you only £250. That’s a management charge of 0.25% – and again, no charge at all for buying or selling funds. With Interactive Investor you would pay just £90 a year for a portfolio of £100,000 or £500,000 - this includes 9 free trades, and after that it's £10 per trade.

Let’s put this into context.

Yes, you may be paying nearly half a percent of your portfolio value every year in fees. (Though with larger portfolios the charges often reduce).

But what about your potential returns, using the Saltydog system?

As I’ve said, my average return is 12% a year over the last five years. Beating the FTSE Total Return by 73%.

And this performance figure takes into account all costs.

In other words, even with the necessary broking charges you can still take full advantage of the Saltydog trend investing system for very healthy returns.

Yes, you’ve paid some costs. But have your gains been eaten up by your trading fees? Not anywhere near.

And so we come to the last thing mainstream investment experts say about trend investing, and why they think you shouldn’t do it.

MAINSTREAM OBJECTION #3:

“Trend investing is too difficult & time-consuming for ordinary investors”

The final objection is that trend investing is just too difficult and time-consuming for the average investor to pursue successfully.

My short answer to this is: nonsense!

But I’ll give you the longer answer too.

Since the Saltydog system is all about actively managing your investments, of course it requires some work and takes up some time compared with passive investing, where you do practically nothing.

So if you don’t want to give up any time at all, or you prefer to have one meeting a year with your financial advisor, for example, then the Saltydog system is definitely not for you.

But is it too difficult or time-consuming? No. At least, not for any investor who wants to properly take control of their their money and out-perform the FTSE – which is a perfectly realistic possibility.

I’ll give you the practical details in a minute. But rest assured, you don’t need any technical skills or complicated financial knowledge. You just need to be able to compare some numbers and look at a few simple charts. It’s really not difficult.

Again, you don’t have to believe me.

Here are some other comments we’ve received from people who have been using the Saltydog system for the past few years:

Simple, easy to use system. Very pleased.

I feel safe and in full control using your system. No unnecessary risk taken. Easy to understand and simple to follow.

The system is easy to use and update. I have used it successfully over the past two years making 15% and 7%.

As I say, these people are not experts or financial professionals – they are private investors just like you.

They find the Saltydog system simple and easy to follow. They have significantly beaten the market. And they have been making consistent, positive returns, even in years when the FTSE 100 has fallen or is flat.

And there’s absolutely no reason why you couldn’t have an equally positive experience, with an equally profitable effect on your investments.

In a moment I’ll explain how you can do this. But first let me tell you how this all started.

I first started using trend investing back in 2000.

It was prompted by a very bad experience I had with my financial advisers.

After selling a successful business in 1985, I invested £150,000 via a financial services company. Being busy building up another multi-million pound business, I paid no attention to my investments, trusting that they were in expert hands.

Silly me.

Fifteen years later, in 2000, I decided to enquire about them - and to my horror discovered that my investments had gone absolutely nowhere. They had effectively been forgotten. The returns were close to zero, whilst the management fees and costs were anything but.

First I was extremely angry at the incompetence of my so-called investment ‘managers’. And then I decided to do something about it.

It’s probably worth telling you that, at various stages in my life, I’ve been a deckhand on a deep-sea fishing trawler, a navigator on a merchant navy ship (hence the name “saltydog”), obtained a degree in Theoretical Physics, and have built up two successful manufacturing businesses worth millions.

In other words, I’m not really one to settle for a conventional approach to life, or conventional answers. I have a habit of working things out for myself. And I have some facility with mathematical analysis.

When it came to taking control of my investments, I took the same approach.

The result was the first version of the Saltydog trend investing system, which I used extremely successfully from the year 2000 onwards, making substantial gains and never losing money in a year – not even in the dotcom crash around 2001, or the financial crisis of 2008, when the FTSE 100 fell 50%.

Whilst I devised this system for my own personal use, I always wanted to help other investors. I felt that they were being badly let down by the financial services industry, as I had been. And so in late 2008 I decided it was time to make my system available to others.

By bringing in a team of experts in finance and engineering, my system was automated, using a series of algorithms. We did many months of back-testing and research. We expanded the data sources, gaining access to the most comprehensive data available, covering tens of thousands of funds. Together with web and design professionals we worked hard on the presentation of the data, so that it was simple to review and understand. And we refined the Saltydog approach even further, making it accessible and easy for anyone to use. We finally launched two years later in 2010.

This is how the Saltydog Investor came about – a system borne out of frustration with mainstream investment approaches, and which has been proven to work over the last fifteen years.

Now let’s get down to some practical details, and how you can use the Saltydog system yourself - to take advantage of rising trends, avoid the big downturns and potentially out-perform the FTSE.

I’ll also tell you how you can receive our in-depth handbook, “How to beat the market using trend investing”, which reveals everything you need to use the Saltydog system effectively and profitably for yourself.

As I mentioned earlier, the Saltydog system is based upon investing in funds, not purchasing individual company shares.

The reason for this is very simple: when I started investing it was using funds, and I developed the system from there.

But there are also three definite advantages of funds:

Now some investors only want to pick individual company shares. That’s fine, but it’s not what the Saltydog system is about.

Other investors object to the large salaries that fund managers get paid, or are concerned about the costs of buying and selling funds.

To be honest, neither of those objections really concern us.

Of course we want to keep our costs down. As I said earlier, you can buy and sell as many funds as you like by paying your broker a reasonable annual management charge.

But ultimately we’re looking at the overall return our investments are making.

FREE SALTYDOG GUIDE:

“How to beat the market using trend investing”

Our free, in-depth guide to trend investing covers:

To claim your free copy, see the details below.

As you’ve seen from my own investment success and from the gains achieved by Saltydog users, we’re consistently performing extremely well.

And that’s the main thing we care about.

So how can you achieve this too?

Here’s how to use the Saltydog system.

First, you’ll need to read our members’ handbook – which won’t take long. It explains how to spot new trends in the market, when to get in, and the best time to get out.

It’s not complicated. Our trend investing rules are simple and easy to follow. Just read the handbook once, and you’ll understand them right away.

Then, every week, we update all the Saltydog data. These numbers and charts – all presented in a very clear, user-friendly format - show the best-performing funds in each sector. You pick out the trends which look most promising and adjust your portfolio accordingly.

And don’t worry, you’re not on your own! Every week we also provide you (by email) with an in-depth commentary on the markets and review the trends which we think look most interesting. So you can use our ideas and guidance to help you make a decision.

Not only that, but – as I’ve mentioned – we also have a Saltydog demonstration portfolio which we update each week, to show the Saltydog principles at work. This means you get to see how we, as experienced users of the system, apply our trend investing rules and interpret all the data.

In addition, we also send you a monthly newsletter through the post, giving you further guidance and and reviewing the market and sector trends.

As you’ve seen from the comments by Saltydog members, using our trend investing system really isn’t hard. It’s easy. And it’s satisfying and enjoyable.

This is what the weekly schedule looks like:

The weekly Saltydog data: clear, colourful and easy to read

On top of this, if you have any questions whatsoever about the system or how you should use it, our Managing Director, Richard, is always here to help. Just send him an email, and he’ll do his utmost to reply as quickly as possible.

And if you decide to try out the Saltydog system you’ll also receive:

In other words, we provide everything you need to become an extremely successful trend investor… joining the other private investors who are already using Saltydog to achieve market-beating gains.

As I hope I’ve made clear, I strongly believe that you can use the Saltydog system to make a big difference to your investments…

In fact I’m so convinced that the Saltydog system will work for you that I’ve made it as easy as possible for you to try out, starting right away.

I’d like to invite you to try out the Saltydog system completely FREE for the next two months.

This means that you’ll receive, for free:

I think this is a fantastic offer, and you really have nothing to lose.

After the two months are up, you might decide that Saltydog is great and you want to keep using it. And if you don’t, that’s perfectly fine and it will have cost you absolutely nothing.

To ride the uptrends & avoid the big drops in the market,

Click here to claim your 2-month FREE TRIAL

of the Saltydog trend investing system.

So what happens if you do want to continue with the system after the two month free trial?

Given the high price of investment services on offer from mainstream financial companies, it would have been easy for us to charge an equally hefty rate. Although there is nothing like the Saltydog system available elsewhere, many stock market data services cost thousands of pounds a year… and aren’t nearly as easy to use as Saltydog.

But we really don’t want the price to exclude the average private investor from the benefits of Saltydog.

For that reason, we’ve kept the annual cost of membership to just £35/month.

And we try to make the payments as easy for you as possible. You don’t have to pay the membership fee upfront all in one go. Instead we only ask you to pay per month, and you can cancel at any time you like.

In other words, you get the first two months of Saltydog completely FREE, and after that the most you’re ever committing is at a time.

Considering that we’re offering you the chance to ride the uptrends, avoid the downturns and potentially beat the market, I really can’t stress enough how good I think this offer is.

If you do take up the free trial, it’s very easy to cancel. Just send us an email at any time during your two-month trial period, to info@saltydoginvestor.com, and I’ll cancel your trial immediately. We don’t take any money until your two-month trial is over. There’s no catch and no small print.

We’re extremely confident in the value of the Saltydog system, and we want you to be completely happy with it.

Should you choose not to continue with the Saltydog service after your trial period, you’ll be able to keep the Members’ Guide and Starter Guide, plus all the emails and newsletters we’ve sent you during the two months, with my compliments.

Remember… the Saltydog system gives you the chance to ride the big uptrends and beat the market.

Now’s your opportunity to really take control of your investments, responding effectively to market movements, and growing your wealth steadily and consistently.

I look forward to welcoming you to the Saltydog system of trend investing.

Just click here to start your 2-month FREE TRIAL.

Yours faithfully

Douglas Chadwick

Founder and Chairman, Saltydog Investor

P.S. Private investors just like you are using the Saltydog system to produce some great returns and protect their wealth, and they love using it.

Here’s what some more very satisfied subscribers have said:

Excellent service… Very impressed with downside protection… A perfect foil to ‘buy and hold’ of the mainstream press.

Trending to around 12% annualised, even with all the trauma of the past few months.

I love the fact that it gives me the confidence to invest my own money with sensible guidance plus the information to enable me to make rational decisions.

The methodology makes sense. The whole idea makes sense… I made 8.5% in 2015 [when the FTSE 100 made a 5% loss] which is no mean feat and largely thanks to the system pointing me towards funds that I had no idea existed.

You could well achieve exactly the same results yourself.

Click on the free trial link below, and within two minutes you’ll have access to all our powerful trend data and can be learning how to use the Saltydog system for market-beating profits.

Just to say again: it’s completely FREE for you to try Saltydog for two full months, with no obligation for you to continue whatsoever. There’s really nothing to lose.

And using the Saltydog approach could add something very special to your investing.

To profit from rising trends, click here for your

of the Saltydog trend investing system